Do Leased Solar Panels Qualify For Energy Credit?

Are you wondering if leased solar panels qualify for energy credit? Well, you’re in the right place! Solar energy is becoming increasingly popular, and many homeowners are considering leasing solar panels instead of purchasing them outright. But when it comes to claiming energy credits, things can get a little confusing. In this article, we’ll explore whether leased solar panels qualify for energy credits and shed some light on this topic.

Leasing solar panels can be a great option for those who want to go solar without the hefty upfront costs. It allows you to enjoy the benefits of renewable energy while paying a fixed monthly fee. But what about the tax incentives and energy credits that come with solar installations? Can you still take advantage of them if you’re leasing? Keep reading to find out!

Understanding the eligibility of leased solar panels for energy credits is crucial for homeowners considering this option. In the following sections, we’ll dive deeper into the topic, exploring the requirements and limitations of energy credits for leased solar panels. So, let’s get started and find out if you can benefit from energy credits with leased solar panels!

Do Leased Solar Panels Qualify for Energy Credit?

Solar panels have become a popular choice for homeowners looking to reduce their carbon footprint and lower their energy costs. However, the cost of purchasing and installing solar panels can be a barrier for many. This has led to the rise of leasing options, where homeowners can sign a contract to have solar panels installed and maintained by a third party. One common question that arises when considering leased solar panels is whether they qualify for energy credits. In this article, we will explore the details of leasing solar panels and their eligibility for energy credits.

Understanding Leased Solar Panels

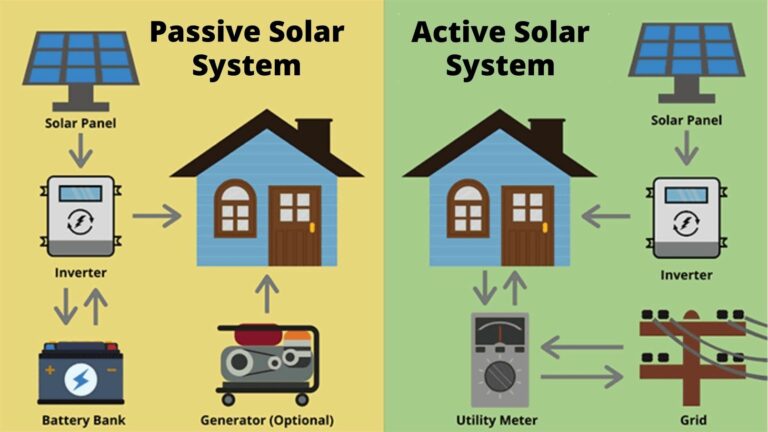

Leasing solar panels offers an alternative way for homeowners to adopt solar energy without the upfront costs. When you lease solar panels, a solar provider installs the panels on your property and retains ownership. You enter into an agreement with the provider to purchase the electricity generated by the panels at a predetermined rate. The solar company is responsible for the maintenance and repairs of the panels throughout the lease term, typically 15-20 years.

Leasing solar panels can be an attractive option for homeowners who want to enjoy the benefits of renewable energy without the high upfront costs. It allows you to start saving on your electricity bills immediately and reduce your reliance on fossil fuels. However, the question remains: do leased solar panels qualify for energy credits?

Eligibility for Energy Credits

To determine if leased solar panels qualify for energy credits, it is essential to understand the different types of credits available. The two main federal energy credits for residential solar installations are the Investment Tax Credit (ITC) and the Residential Energy Efficient Property Credit (REEPC).

The Investment Tax Credit (ITC) allows homeowners to claim a credit for a percentage of their solar energy system’s cost. For leased solar panels, the leasing company is typically the owner of the system and becomes eligible for the ITC. As the homeowner, you benefit from lower electricity costs but do not directly qualify for the tax credit.

On the other hand, the Residential Energy Efficient Property Credit (REEPC) allows homeowners to claim a credit for a percentage of the costs associated with qualifying energy-efficient property, including solar panels. However, the REEPC is only available for property owned by the taxpayer. Since leased solar panels are owned by the leasing company, the homeowner does not qualify for this credit.

While you may not be eligible for the REEPC as a lessee, the benefits of leasing solar panels extend beyond tax credits. You can still enjoy reduced electricity costs and the environmental benefits of renewable energy.

Pros and Cons of Leased Solar Panels

Leasing solar panels offers several advantages and considerations that homeowners should take into account before making a decision.

Benefits of Leased Solar Panels:

1. No upfront costs: Leasing solar panels eliminates the need for a large upfront investment, making it more accessible for homeowners.

2. Immediate savings: By leasing solar panels, you can start saving on your electricity bills from day one.

3. Maintenance included: The leasing company is typically responsible for the maintenance and repairs of the solar panels, saving you from additional costs and hassle.

4. Flexibility: Leasing agreements often come with options to buyout the system or transfer the lease if you decide to sell your home.

Considerations of Leased Solar Panels:

1. Ownership: With leased solar panels, you do not own the system, and the leasing company retains ownership. This means you do not benefit from certain tax credits or the ability to sell excess energy back to the grid.

2. Long-term commitment: Leasing agreements typically have long-term contracts, ranging from 15-20 years. It’s important to consider the length of the commitment before signing the lease.

3. Potential limitations: Some leases may come with restrictions on system upgrades or modifications. It’s crucial to review the terms carefully to ensure they align with your needs and preferences.

In conclusion, while leased solar panels may not qualify homeowners for certain energy credits, they still offer significant financial and environmental benefits. Before making a decision, it’s essential to weigh the pros and cons, review the terms of the lease agreement, and consider your long-term goals. Leasing solar panels can be a stepping stone towards a greener future and a more sustainable energy source for your home.

Key Takeaways: Do Leased Solar Panels Qualify for Energy Credit?

- Leased solar panels can qualify for energy credits.

- Energy credits are incentives provided by the government to promote renewable energy.

- When you lease solar panels, you typically don’t own them, but you can still benefit from the energy credits.

- By leasing solar panels, you can enjoy the advantages of solar power without the upfront costs of purchasing the system.

- Make sure to check with your solar leasing company and local tax authorities to understand the specific requirements for qualifying for energy credits.

Frequently Asked Questions

Here are some common questions related to leased solar panels and their eligibility for energy credits:

1. How do leased solar panels qualify for energy credit?

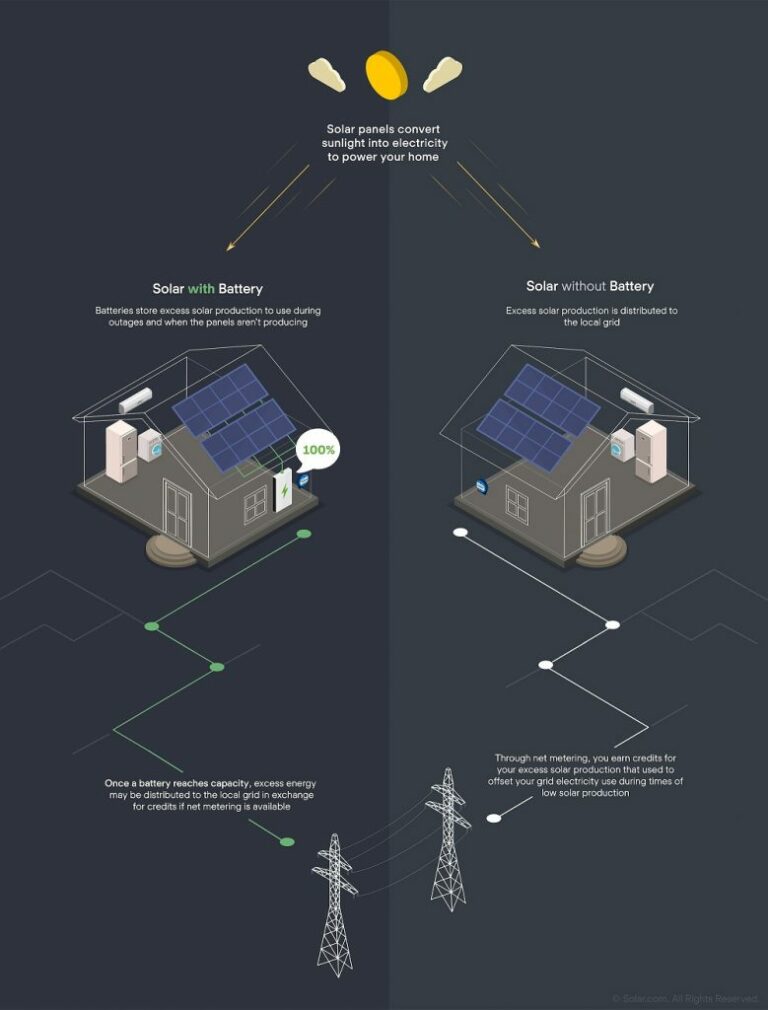

Leased solar panels can indeed qualify for energy credits, depending on certain factors. In most cases, the energy credits are claimed by the owner of the solar panels, which is usually the leasing company. They are then able to pass along the benefits of these credits to the lessee, usually in the form of reduced monthly lease payments. So while the lessee may not directly claim the energy credits, they can still reap the financial rewards of the credits through their lease agreement.

It’s important to note that the specifics of energy credit eligibility can vary by location and the terms of the lease agreement. It’s best to consult with the leasing company and tax professionals to understand the exact details and potential savings associated with energy credits for leased solar panels.

2. Can I claim the energy credit if I lease solar panels from a third-party provider?

If you are leasing solar panels from a third-party provider, the ability to claim energy credits may depend on the terms of your lease agreement. In some cases, the third-party provider may be the one entitled to claim these credits, while passing along the financial benefits to you, the lessee. However, this can vary, so it’s essential to review the terms of your lease agreement and consult with tax professionals to understand if you are eligible for energy credits.

Keep in mind that while you may not be directly claiming the energy credits, the potential savings from these credits are often factored into the lease agreement. This means that even if you can’t claim the credits yourself, you can still benefit from reduced lease payments and potentially a lower overall cost of energy.

3. Are there any specific requirements for solar panels to qualify for energy credit?

Yes, there are specific requirements for solar panels to qualify for energy credit. In the United States, for instance, solar panels must meet certain standards to be eligible for the federal solar investment tax credit (ITC). These standards typically include the requirement that the solar panels are used for residential or commercial purposes and are installed in accordance with applicable guidelines and permits.

Additionally, the solar panels must meet certain efficiency standards to qualify for the ITC. These efficiency requirements ensure that the solar panels generate a sufficient amount of clean energy to be eligible for the tax credit. It’s important to consult with solar panel manufacturers, leasing companies, or tax professionals to understand the specific requirements in your region and determine if the leased solar panels meet these criteria.

4. Can I claim energy credits for both leased solar panels and other renewable energy systems?

In many cases, you may be able to claim energy credits for both leased solar panels and other renewable energy systems, such as wind turbines or geothermal heating systems. These credits can vary depending on the specific system and its eligibility criteria. It’s important to review the tax laws and regulations in your area and consult with tax professionals to understand the potential credits available for different renewable energy systems.

Keep in mind that the availability and amount of energy credits for various systems can change over time, as government policies and incentives evolve. Staying informed about these changes and understanding the eligibility criteria for different energy systems is crucial to maximizing your potential savings through energy credits.

5. Do I need to report leased solar panels and energy credits on my tax return?

Yes, leased solar panels and the associated energy credits should typically be reported on your tax return. While the specifics can vary by location and individual circumstances, it’s generally required to report any income or financial benefits received from the leased solar panels as part of your tax filing.

Additionally, you may need to provide documentation related to the lease agreement, including details of any energy credits received, to support your tax filing. It’s important to keep accurate records of these documents and consult with tax professionals to ensure you are meeting your reporting obligations and maximizing your potential tax benefits.

The Solar Tax Credit Explained [2023]

Summary

Leasing solar panels can be a great way to go green and save money. However, whether or not you qualify for energy credits depends on the terms of your lease and where you live. Some states allow leased panels to qualify, while others have more specific requirements. It’s important to do your research and understand the rules in your area before making a decision.

In general, owning the solar panels outright is more likely to make you eligible for energy credits. However, leasing can still be a cost-effective option if you can’t afford to buy them upfront. Just be sure to check with your local authorities and the leasing company to see if you can still benefit from energy credits while leasing.